when will i get my minnesota unemployment tax refund

When Should I Expect My Tax Refund In 2022. We expect to adjust and issue refunds for the remaining 10000 affected returns early in 2022.

Congress Wants To Waive Taxes On Unemployment Some States May Not

The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness.

. The Minnesota State Capitol in Saint Paul Minnesota. How to calculate your unemployment benefits tax refund. This means if it takes the IRS the full 21 days to issue your check and your bank five days to post it you could be waiting a total of 26 days to.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. What You Will Need Social security number or ITIN Your filing status Your exact refund amount. The average refund for all processed returns is currently 584 according to the Minnesota Department of Revenue.

IRS Form 1099-G will be mailed to everyone who was paid Minnesota unemployment benefits in 2021. Individuals earning less than 150000 a year were exempted from paying taxes on up to 10200 in unemployment insurance payments under that statute. If you received unemployment in 2020 youll likely get money back from the Minnesota Department of Revenue.

However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Minnesota Department of Revenue set to begin processing Unemployment Insurance and Paycheck Protection Program refunds. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable.

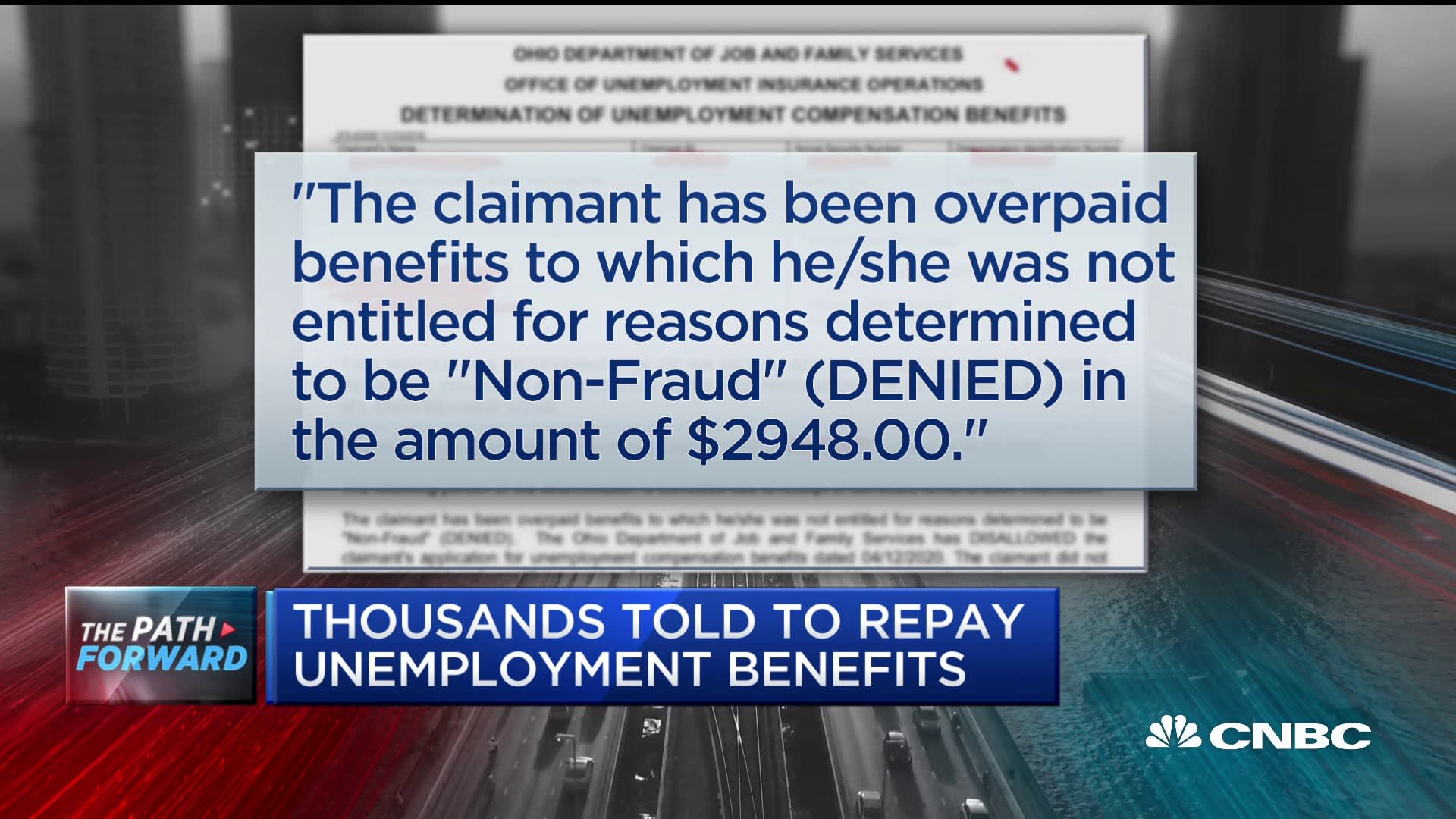

The first phase included the simplest returns made by single taxpayers who didnt claim for children or any refundable tax credits. 1 Best answer. Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments issued during the pandemic likely wont go out until September a Department.

In these cases its taking the IRS more than the typical 21-day time frame to issue related refunds in some instances stretching to between 90 days and 120 days. However many people have experienced refund delays due to a number of reasons. PPP UI tax refunds start this week in Minnesota.

The form shows the total benefits paid and all federal and state income taxes withheld. The IRS anticipates most taxpayers will receive refunds as in past years. However up to 508000 households have already - or will get - a refund before the end of the year.

Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days. The child tax credit checks began going out in july and will continue monthly through december for eligible families. This process is expected to be finished in early 2022 meaning some will have to wait until next year to get a refund.

About 500000 Minnesotans are in line to. When will I get the refund. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans.

Download the IRS2Go app to check your refund status. The IRS normally releases tax refunds about 21 days after you file the returns. PAUL WCCO Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks the Minnesota Department of Revenue said Thursday after the legislature signed off on a tax relief package before ending their work.

Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. These tax law changes were enacted July 1 2021 along with other retroactive provisions affecting tax years 2017 to 2020.

Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns. First the IRS is working through a. FOX 9 ST.

Weve finished adjusting and issuing refunds for all 2200 entity-level corporate returns affected by the PPP changes. The form will be mailed to the address listed in your account on December 31 2021. The IRS began issuing refunds to individuals who got unemployment benefits in 2020 and paid taxes on them before the American Rescue Plan took effect in late May.

MN Department Of Revenue Will Begin Sending Tax Refunds For PPP Loans And Extra Jobless Aid In Next Few Weeks July 1. Mailing will begin in mid-January and will be completed by January 31 2022. September 30 2021 249 PM.

Article continues below advertisement How will I receive the. Using a Mobile Device. Refund for unemployment tax break.

Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the COVID-19 pandemic. The agency is working its way down to the more complex category and expects to complete releasing jobless tax refunds before Dec. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month.

The number of returns requiring. Most should receive them within 21 days of when they file electronically if they choose direct deposit.

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Do I Need A Degree To Work In User Experience Interaction Design Foundation College Degree Educational Infographic Education College

Minnesota Unemployment Relief For Covid 19

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Cutoff Of Jobless Benefits Is Found To Get Few Back To Work The New York Times

Can I Restart My Unemployment What To Know If You Re Laid Off Again

As High Unemployment Persists Minnesota Borrows To Pay More Benefits Federal Reserve Bank Of Minneapolis

Unemployement Benefits Are This Payments Taxable Marca

Calculate Child Support Payments Child Support Calculator Parental Income Inf Child Custody Cal Child Support Quotes Child Support Payments Child Support

Unemployment Insurance Claim How Can You Claim Them Due To Covid 19 Reasons Marca

When Will Irs Send Unemployment Tax Refunds Kare11 Com

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Unemployment Compensation Are Unemployment Benefits Taxable Marca

13 States Won T Let You Claim Biden S 10 200 Unemployment Tax Break